is car loan interest tax deductible in india

Bussan Auto TW North India - Haryana Jammu and Kashmir Punjab Online Auction Location. In Indian context if the loan is taken for business than you can claim interest paid on mortgage loan as deduction from business profits.

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

The benefit Section 80EEB can be claimed by individuals only.

.jpg)

. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit. Car loans availed by individual customers do not offer any tax benefit. Thus you are not.

For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. Cars are considered a luxury product in India and many people avail loans to purchase their dream cars.

All about tax benefits on loans in India. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can. This means that if you pay.

Answer 1 of 2. From FY 2020-2021 onwards tax incentives under Section 80EEB are available. You cant claim deduction of car loan if its not an electric car in case of.

To claim car loan tax exemptions from Income Tax you need to show that you are using the car for legitimate business purposes and. When you file your taxes with the Internal. People who choose to acquire an EV on loan will be eligible for a tax deduction of Rs 15 lakh.

You can write off up to 100. Recently in Phillips India Ltd. If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes.

Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. For vehicles purchased between December 31 1996. Show you use the car for legitimate business purpose.

Tax benefits on Car Loans. Article continues below advertisement. For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns.

How to show home loan interest for self occupied house in. Principal loan amount is not tax deductible and do not offer any tax benefit. This means that if you pay 1000.

Tax Exemptions on 10003 Home Loans 10003 Education Loans 10003 Car Loans 10003 Auto Loans 10003 Personal Loans. The student loan interest deduction allows you to deduct up to 2500 If you meet all of the eligibility criteria the maximum amount of interest you can deduct per year is 2500. Is car loan interest tax deductible in india.

So when you are claiming tax rebate on car loan deduct the. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation. 10 Interest on Car Loan 10 of Rs.

If its a loan for buying a commercial or. Central Bank of India. An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 15 lacs us 80EEB.

The interest paid on a business loan is usually. Business loan interest amount is tax exempted. To deduct interest on passenger vehicle loans take the lesser amount of either.

10 x the number of days for which interest was payable. North India Starts at. The answer to is car loan interest tax deductible is normally no.

Does A Car Loan Reduce My Income Tax Quora

Nonprofit Law In India Council On Foundations

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

When Is Car Insurance Tax Deductible Valuepenguin

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank

/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

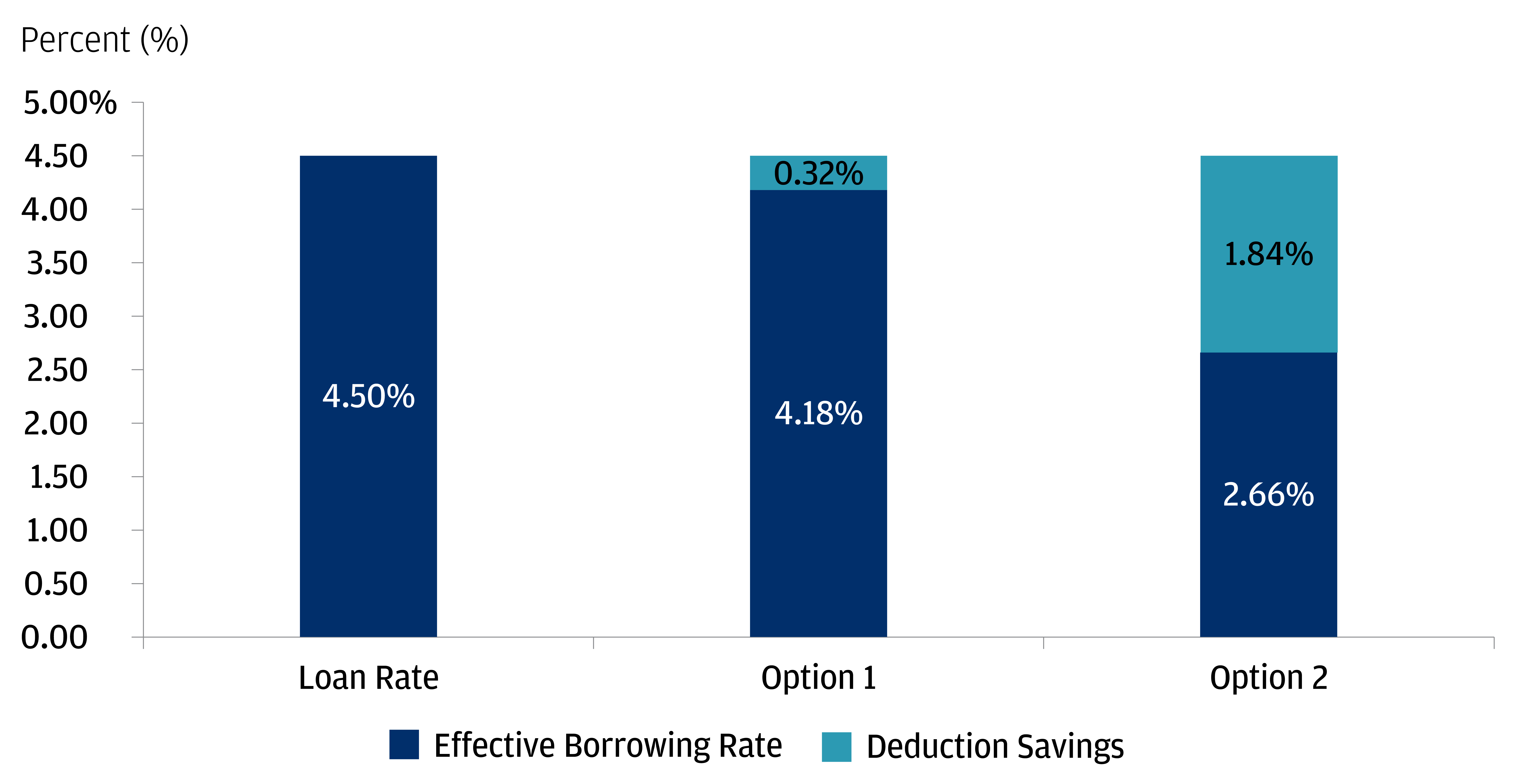

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

Tips To Use Tax Benefits That Are Available On Home Businesstoday Issue Date Jan 01 2015

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage